Buy-and-Build and Leveraged Buy-Outs: How Private Equity Really Creates Value in the European Mid-Market

For founders, CEOs and investors of leading privately owned businesses, Private Equity (PE) has become far more than an “exit option.” In today’s European mid-market, PE is often a strategic growth partner—one that brings capital, discipline and a clearly defined value-creation playbook.

Among the many PE strategies, two dominate outcomes for established, profitable businesses: Leveraged Buy-Outs (LBOs) and Buy-and-Build platform strategies. These approaches account for the majority of capital deployed in the European mid-market and are the strategies most relevant to owners seeking liquidity without sacrificing future upside.

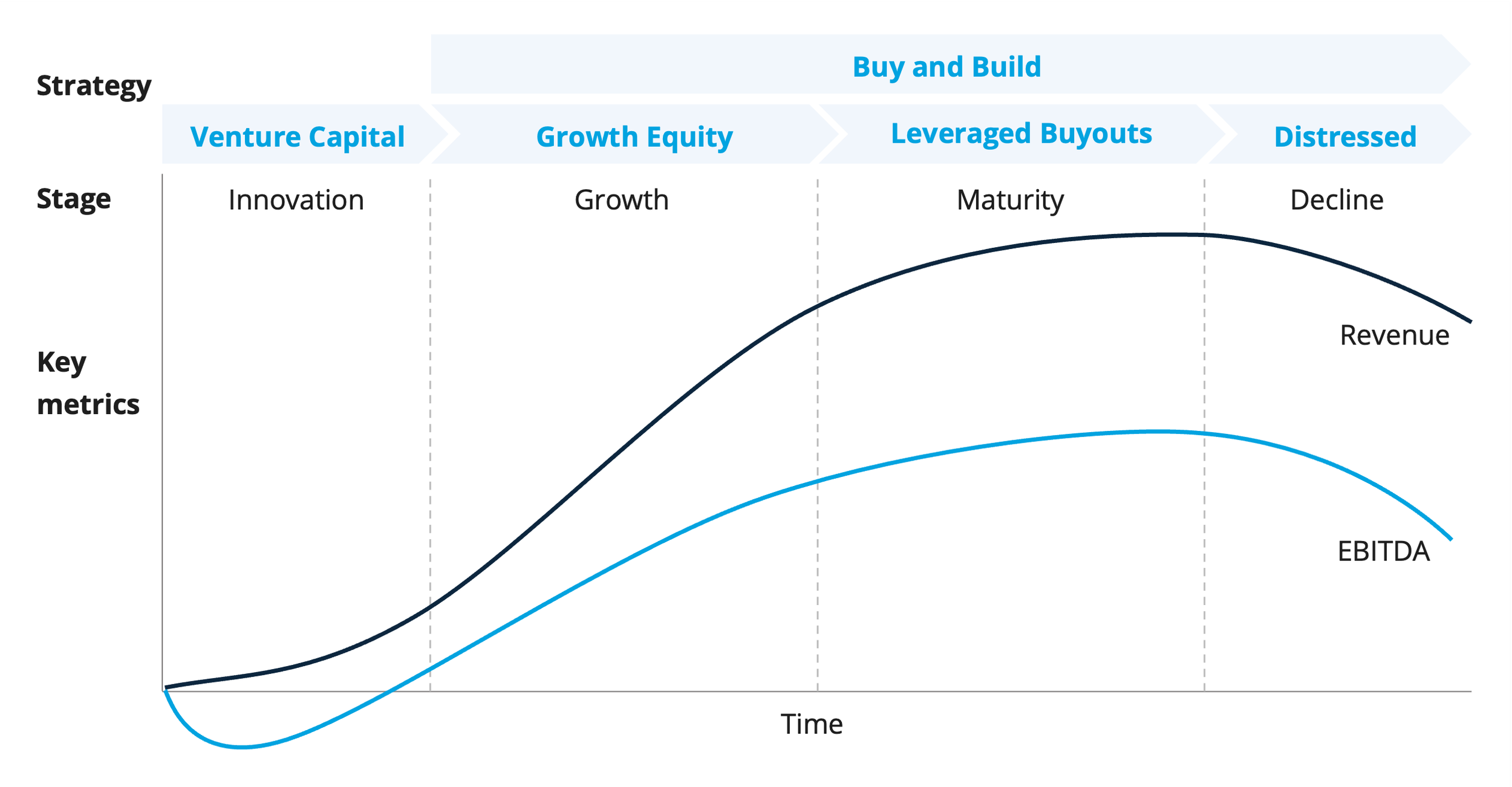

Private Equity strategies across the business cycle

Private Equity beyond the headline: why strategy matters

Private Equity is often spoken about as a single buyer type. In reality, it is a collection of distinct investment strategies, each with narrow mandates defined by fund documentation, investor expectations and risk tolerance. Funds cannot “switch strategy” mid-process; they invest strictly within these parameters.

For owners, this distinction matters enormously. A business that is highly attractive as a Buy-and-Build platform may be far less compelling as a standalone LBO—and vice versa. Understanding where your business fits is the starting point for achieving premium valuation and favourable deal terms.

Across Europe, LBOs and Buy-and-Build strategies sit firmly in the maturity phase of the business lifecycle: established revenues, positive EBITDA, defensible market positions and predictable cash flows.

Leveraged Buy-Outs: liquidity, discipline and alignment

A Leveraged Buy-Out involves a Private Equity firm acquiring a controlling stake in an established, cash-generative business using a combination of equity and debt. The company’s cash flows service that debt, while operational improvements and growth initiatives drive equity value over time.

Why LBOs dominate the mid-market

According to industry data from Invest Europe, buy-outs account for the largest share of PE investment by value in Europe. The reason is simple: LBOs balance risk control with return potential.

From an owner’s perspective, LBOs offer several compelling advantages:

Immediate liquidity – Founders typically sell 60–90% of the business, significantly de-risking personal wealth.

Retained upside – A meaningful minority rollover (often 10–40%) allows participation in future value creation.

Professionalisation – PE ownership accelerates improvements in governance, reporting, systems and management depth.

Clear exit horizon – Most LBOs target an exit within 4–7 years, providing clarity and optionality.

Crucially, LBOs are not purely financial exercises. While leverage enhances returns, it also enforces discipline. Businesses must generate predictable cash flows, manage working capital tightly and execute on clearly defined value-creation levers.

What makes an LBO work

Successful LBOs are underpinned by three fundamentals:

Cash flow durability

Stable, visible EBITDA is non-negotiable. Volatility reduces safe leverage and quickly erodes valuation.Operational value creation

PE investors look for tangible levers: pricing optimisation, margin improvement, professionalised sales, geographic expansion or selective acquisitions.Management alignment

Retained equity and incentive plans align founders and executives with the PE sponsor. When incentives are clear and realistic, performance follows.

LBOs fail most often when leverage is pushed too aggressively or when returns rely primarily on valuation multiple expansion rather than intrinsic improvement—a risk highlighted repeatedly in European mid-market data.

Buy-and-Build: turning fragmentation into scale

If LBOs are about discipline, Buy-and-Build strategies are about momentum.

In a Buy-and-Build, a PE firm acquires a strong platform company and then executes a series of add-on acquisitions in a fragmented market. The goal is to build scale, diversify revenues, professionalise operations and ultimately achieve a valuation multiple that individual businesses could not command alone.

Why Buy-and-Build is so powerful in Europe

Europe is uniquely suited to Buy-and-Build strategies. Many sectors remain highly fragmented, founder-owned and sub-scale at the individual company level. Private Equity brings the capital, systems and experience required to consolidate these markets.

Common Buy-and-Build sectors include:

Business services (outsourcing, IT services, compliance, facilities management)

Healthcare (dental, veterinary, outpatient clinics, diagnostics)

Specialist industrial and technical services

Education and training platforms

External research from Preqin consistently shows that Buy-and-Build deals outperform single-asset buy-outs when executed well, driven by EBITDA growth, deleveraging and multiple expansion.

The role of the founder-CEO in Buy-and-Build

For founders, Buy-and-Build can be particularly attractive. Rather than exiting completely, the founder often becomes the CEO of a growing group—supported by PE capital and M&A expertise.

This creates what many call a “second act”:

Leading a larger, more professional organisation

Acquiring competitors rather than being disrupted by them

Participating in a second, often larger, exit event

However, Buy-and-Build is execution-intensive. Integration risk, cultural alignment and management bandwidth are real challenges. The platform business must be robust enough to absorb acquisitions without losing focus on the core.

LBO vs Buy-and-Build: which is right for your business?

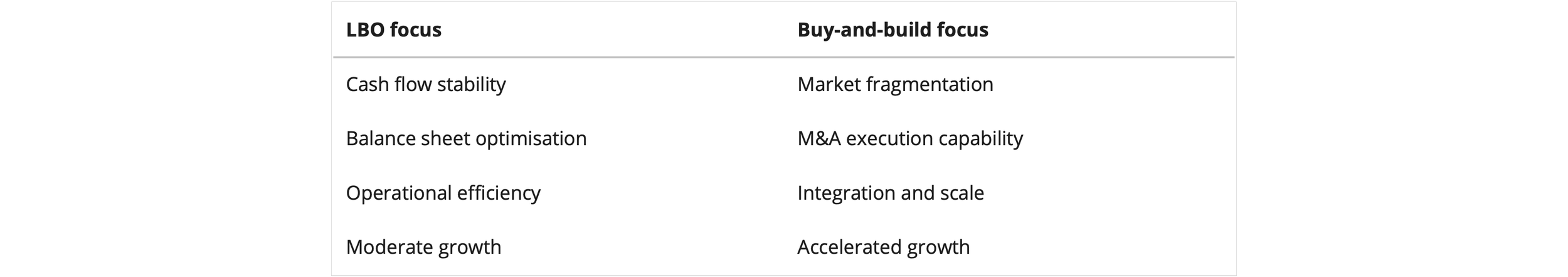

While the strategies often overlap, the distinction is important:

Many of the most successful PE investments combine both approaches: an LBO platform followed by a Buy-and-Build programme.

For owners, the key question is not “Which strategy is better?” but rather which strategy best fits your business, your market and your personal objectives.

To learn more about how Private Equity works, download our Report “Exit to Private Equity - An Insider Guide for Founders, CEOs and Professional Investors”.

Valuation reality: how PE thinks about price

Private Equity does not value businesses the way public markets do. Instead of earnings per share or dividends, PE focuses on EBITDA and cash generation—because these determine leverage capacity and exit value.

Two points matter most for owners:

Adjusted EBITDA drives value

Small, defensible adjustments to EBITDA can translate into substantial enterprise value uplifts when multiplied across PE valuation multiples.Process creates premiums

The highest valuations rarely come from bilateral discussions. Competitive, well-run processes - particularly cross-border ones - consistently deliver superior outcomes.

Our experience shows that top-quartile PE processes can achieve valuation premiums of 30–50% over sector averages when preparation, positioning and buyer selection are executed properly.

Why advisers matter more than ever

Engaging with Private Equity is not a conversation; it is a campaign. PE firms deploy experienced deal teams and armies of advisers whose sole mandate is to manage risk and optimise returns.

For founders running businesses day-to-day, this creates a natural asymmetry.

An experienced sell-side adviser does far more than “run a process.” At Dyer Baade & Company, our role is to:

Position the business using an investor-grade equity story

Identify the right PE strategies and funds—not just interested ones

Create competitive tension across borders

Anticipate diligence pressure points before they become deal issues

Negotiate not only price, but structure, control and downside protection

The difference between an average PE deal and a market-leading one is rarely the business itself. It is almost always preparation, strategy and execution.

A strategic choice, not just an exit

For the right businesses, Buy-and-Build and Leveraged Buy-Outs offer something unique: liquidity without disengagement, growth without undue personal risk, and partnership rather than absorption.

But these outcomes are not automatic. They require:

A clear understanding of PE strategies

Honest assessment of business readiness

Early, disciplined preparation

An adviser who understands how PE investors really think

Next steps: explore your options confidentially

If you are a founder, CEO or investor in a high-quality privately owned business and want to understand whether an LBO or Buy-and-Build strategy could unlock a premium outcome for you, we invite you to have a confidential conversation with us.

At Dyer Baade & Company, we specialise in advising leading mid-market businesses across Europe on exits to Private Equity - bringing strategic clarity, international reach and a relentless focus on outcomes.

This article reflects Dyer Baade & Company’s experience advising founders, CEOs, and professional investors of privately owned businesses across Europe on Private Equity and alternative ownership strategies.