Exiting to Private Equity?

Secure your deal at market leading terms.

Most founders underestimate the vast asymmetry when negotiating with Private Equity.

We help our clients to structure deals to their advantage, with a particular focus on deals in the £20 - 200m valuation range.

~85%

of our deals involve

Private Equity

+90%

Transaction

success rate

+34%

Average valuation

premium achieved

The asymmetry between founder and Private Equity

A sale to Private Equity is rarely a balanced negotiation - It is a high-stakes transaction between an owner making a once-in-a-lifetime decision and an investor executing a disciplined, repeatable model built to extract return and control risk. Over a period of typically 2 - 8 months, you negotiate against:

Dedicated deal teams

Big Four financial due diligence

Tax specialists

Legal advisers

Strategy consultants

Operating partners

Structured investment committee processes

In many cases, 20–50 specialists analyse a single mid-market transaction. Most founders underestimate this asymmetry. The result?

Valuation anchored early

Adjusted EBITDA challenged

Structure shifted in favour of the buyer

Deal fatigue leading to concession

Re-trading late in exclusivity

Private Equity firms are professional investors. Their mandate is to maximise return and minimise risk. Yours is to maximise value and protect downside. These objectives are not identical. Evaluate your position before entering a process.

What ultimately determines your negotiation power and deal outcome

Quality of Earnings

Is your EBITDA predictable, defensible, and leverageable?

Adjusted EBITDA Credibility

Are adjustments well-supported, transparent, and institutionally defensible?

Competitive Tension

Are multiple Private Equity firms and strategic buyers competing - or is there one dominant buyer?

Leverage Capacity

Can the business safely support debt without increasing perceived risk?

Sector Dynamics

Are you positioned within a fragmented market suitable for buy-and-build?

Exit Visibility

Can a clear 4–7 year value-creation story be articulated?

Two companies with similar EBITDA can trade at materially different multiples.

Independent counsel, strategic planing, and professional execution are essential to achieve a market leading result.

Is your business suitable for a Private Equity exit?

Most mid-market PE investors look for:

€15m+ revenue and/or €5m+ EBITDA (there are exceptions)

Strong cash flow and margin profile

Low capital intensity

Scalable operating model

Diversified client base

Professional management team

Reduced founder dependency

Clear valuation creation plan and a strong investment case

Businesses that struggle to attract PE typically show:

Sub-scale operations

Volatile earnings

High customer concentration

Weak financial transparency

Overreliance on one individual

Structural sector decline

Clear valuation creation plan and a strong investment case

Understanding where you sit on this spectrum is critical before approaching the market.

The Cost of a Failed Process

Entering discussions about a potential business sale with a Private Equity firm or a strategic investor create exposure. Once you enter the market, you cannot fully reverse that decision. A poorly prepared or poorly managed sale does not simply “not happen” - it leaves consequences:

Most sell-side processes fail to close as originally intended – Industry experience shows that a significant proportion of (mostly unadvised) transactions of privately owned businesses either collapse or complete on materially revised terms. Once momentum stalls, buyer confidence weakens and negotiating leverage shifts.

Management distraction at the worst possible time – A sell side process demands hundreds of data requests, meetings and diligence sessions. While you are defending adjustments and forecasts, competitors continue selling, hiring and executing.

Performance slippage directly impacts valuation – Even modest underperformance during a process can trigger re-trading, price reductions or structural concessions - and they are more likely as a result of the distractions that come with sell side process, in particular if management is not supported by specialist M&A advisers. Buyers do not ignore weakness - they price it.

Second-round valuation pressure (“tainted asset” effect) – If a process fails or leaks, future buyers may assume hidden issues. A business that has already been “to market” often faces harder questions and more conservative pricing.

Reputational and organisational impact – Senior employees, lenders and key customers may sense instability. Uncertainty can erode morale, retention and commercial confidence long before a deal completes.

Material financial cost regardless of outcome – Legal, accounting and advisory expenses accumulate quickly, whether or not a transaction closes. A failed process can result in six- or seven-figure costs with no liquidity event to offset them.

Opportunity cost in volatile markets – Market windows do not stay open indefinitely. Time spent in an unsuccessful process may mean missing stronger macro conditions, favourable credit markets or strategic buyers.

Confidentiality leakage risk – The wider the distribution of sensitive information, the greater the chance that competitors, suppliers or even employees become aware. Once strategic data leaves the room, control is reduced.

Internal trust erosion – If shareholders or management were aligned around an exit that does not materialise, confidence in leadership and strategic direction can weaken.

Founder fatigue and negotiation erosion – Extended diligence and exclusivity periods gradually shift leverage. After months of pressure, many founders concede on structure or price simply to conclude the process.

A transaction process is not neutral. When handled without strategic control, it can quietly reduce valuation, increase risk and limit future optionality. When structured properly, it does the opposite - it strengthens leverage, preserves confidentiality and maximises outcome.

How do Private Equity firms value businesses and what returns are possible?

How PE firms come up with their valuations:

Private Equity firms are professional investors who invest based on financial models, different scenarios and the target firms overall cashflow profile.

In doing so, PE firms focus very much on the EBITDA profile of a target firm - or to be precise on the adjusted EBITDA profile - usually tracking the last 3 years, the entry year and the projections for the next five years.

What returns are possible:

Private Equity firms measure their investment success, by using two key metrics: Internal Rate of Return (IRR) and Multiple of Invested Capital (MOIC).

At the lower end, PE firms target 15-20% IRR and ~2.0x MOIC.

At the top end, PE firms target +25% IRR and 3.0x MOIC.

Depending of the strengths of the investment case, c80% of all Private Equity deals are completed at a valuation ranging between 6x - 16x EBITDA.

How we generate premium outcomes for our clients

Learn more about how we can help you to achieve a premium outcome

Independent Perspective

Our independence is not a marketing label - it is a key value adding factor. We are not part of a larger firm that relies on PE firms for constant deal flow for other services. We have deep knowledge of market standard terms and have no hesitations to go to battle for our clients to achieve the best possible results.

Strategic Foresight

Our work starts with a comprehensive analysis with the aim to develop a strategy that maximises outcome for our clients, focusing on price, deal structure, governance, Rollover equity, downside protection and future exit optimality.

International Reach

There are over 4,000 Private Equity firms across Europe. With our deep knowledge of the PE community in the UK and Europe, we create competitive tension to increase optionality and ensure the best possible results.

Specialisation in Private Equity

Because we specialise in PE transactions, we understand how investment committees price risk, where leverage shifts and how valuation is underwritten. That insight allows us to position businesses more credibly and structure competitive dynamics that enhance both price and deal terms.

What results can we deliver

~85%

of deals involve

Private Equity

Based on winning bidders. Percentage increases to ~95%, when underbidders are included.

+90%

Transaction Success rate

Includes all Dyer Baade sell-side mandates between 2020-2026.

+34%

Average valuation premiums achieved

Based on 157 comparable transactions between 2020 - 2026.

What our clients say about us

Frequently asked questions

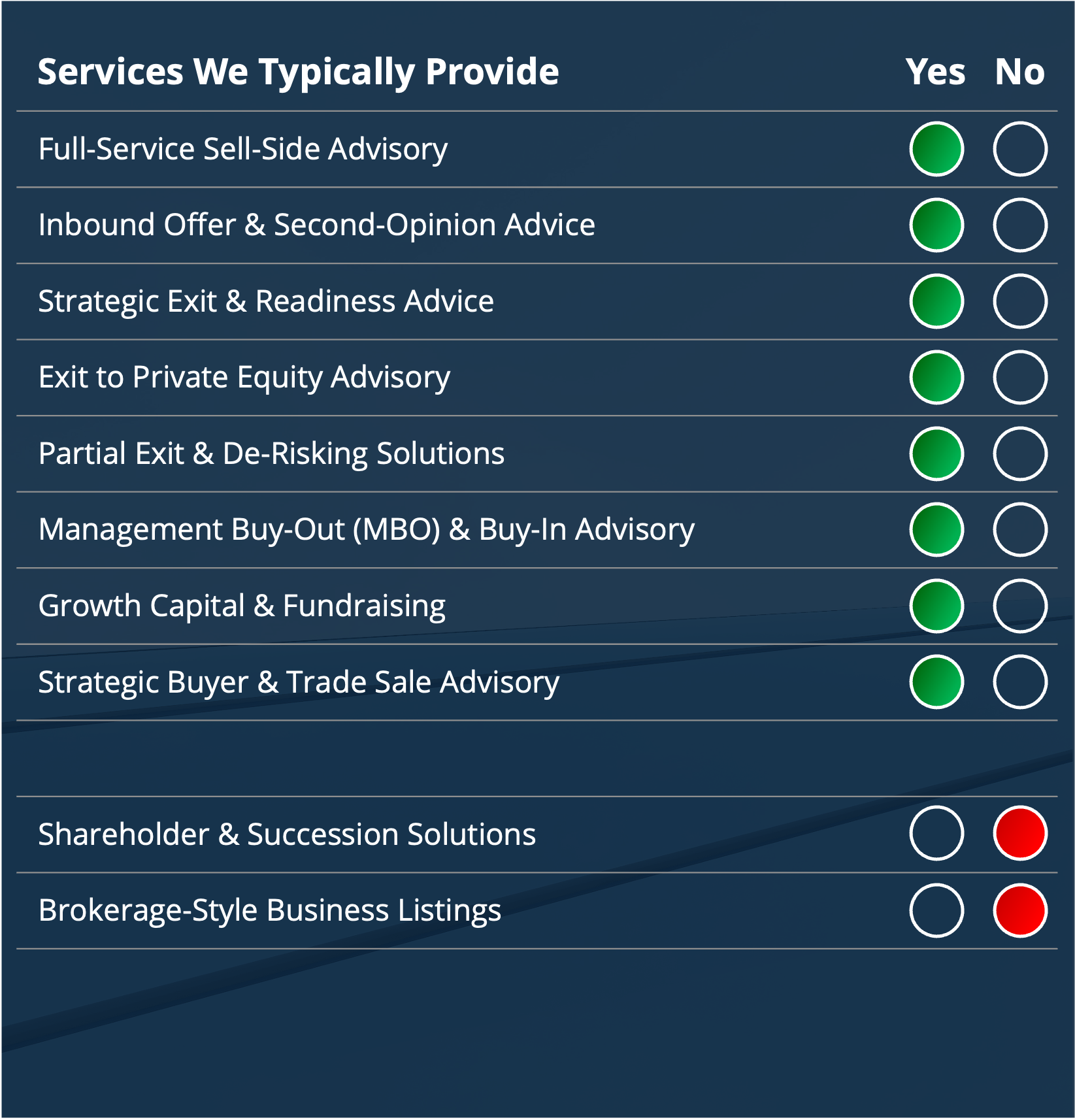

Are you exclusively focused on exits to Private Equity?

Private Equity are the dominate investor in the mid-market, either directly via platform investments or indirectly via bolt-on investments. Nevertheless, we will almost always also include other potential investors like family offices, strategic buyers, etc. to ensure the best possible outcome for our clients.

You are based in London. Do you also work with European clients?

Yes.

Will you treat my inquiry confidential?

Yes. Both the fact that you get in touch with us and what you share with us, will stay entirely confidential.

How do I know if you can help or if the timing is right?

We will take the time to understand your enquiry and will give you a confidential and honest feedback.

Who can you help?

To answer this question we have produced a list of the most common situations: