Strategic M&A advice for founders considering a Private Equity exit.

Headquartered in St. James, London, we are independent specialists in mid-market Private Equity transactions across the UK and Europe.

+40

Completed

Transactions

£20-200m

Typical

deal value

~85%

of deals involve

Private Equity

+90%

Transaction Success rate

(2020-2026)

+34%

Average valuation premiums achieved

Why Private Equity sets the tone for mid-market deals

If your business is valued between £20 - 200m, Private Equity is not just a buyer - it is the market. In this segment most serious bidders are either Private Equity firms themselves or businesses already backed by them. They are well-capitalised, acquisition-driven, and professionally prepared to compete.

Private Equity funds are the natural buyers of strong, scalable businesses that can be used as a platform for a buy-and-build strategy. If your company has momentum, recurring revenues, or fragmentation upside, it will almost certainly be assessed through a Private Equity lens.

At the same time, PE-backed companies are among the most aggressive acquirers of bolt-ons. They have committed capital, defined acquisition mandates, and boards that expect disciplined growth through M&A. In many sectors, they move faster - and with more conviction - than traditional trade buyers.

Even when the final acquirer is strategic, valuation dynamics are typically anchored by Private Equity participation. When multiple funds are at the table, pricing rises, structures sharpen, and leverage shifts. When they are absent, valuation ceilings are often lower.

For founders and CEOs, this matters. If Private Equity is the benchmark buyer in your market, then understanding how they evaluate risk, price growth, and structure deals is not optional. It directly shapes what your business is worth - and how much you ultimately take home.

In the £20-200m range, Private Equity does not simply participate in deals. It defines them. To learn more about how Private Equity really works, download our Insider Guide: Exit to Private Equity

Why founders need a strategic and independent M&A Adviser

When you engage with Private Equity - or a sophisticated strategic buyer - you are stepping into their world. Across the table sit professional investors and corporate acquirers who do deals for a living. They have dedicated deal teams, external advisers, investment committees, and structured negotiation playbooks. Their objective is simple: Buy well. Control risk. Protect return.

As a founder, your stakes are different: This is likely the largest financial decision of your life where you crystalise years - often decades - of work. A moment that defines your personal wealth and legacy.

Without strategic representation, the imbalance is real: Valuation can be anchored too early, Adjusted EBITDA can be challenged aggressively, Structure can shift quietly in favour of the buyer. Exclusivity can erode your leverage.

An independent M&A adviser restores balance - fully aligned with your outcome, strategically creating competitive tension before negotiations begin, and rigorously protecting valuation and deal terms throughout the entire process.

In this segment, roughly defined as firms with more than £15m revenue or more than £5m EBITDA, independent counsel, strategic preparation, and the ability to attract interest from multiple buyers - regional and International - determine whether you command a premium - or concede one.

What makes us unique?

Dyer Baade & Company was founded by industry veteran Stuart Dyer and strategy expert Dr. Daniel Baade with the mission of delivering exceptional M&A results for founders, CEOs, and professional investors of leading privately owned businesses, with a particular focus on deals in the £20-200m range.

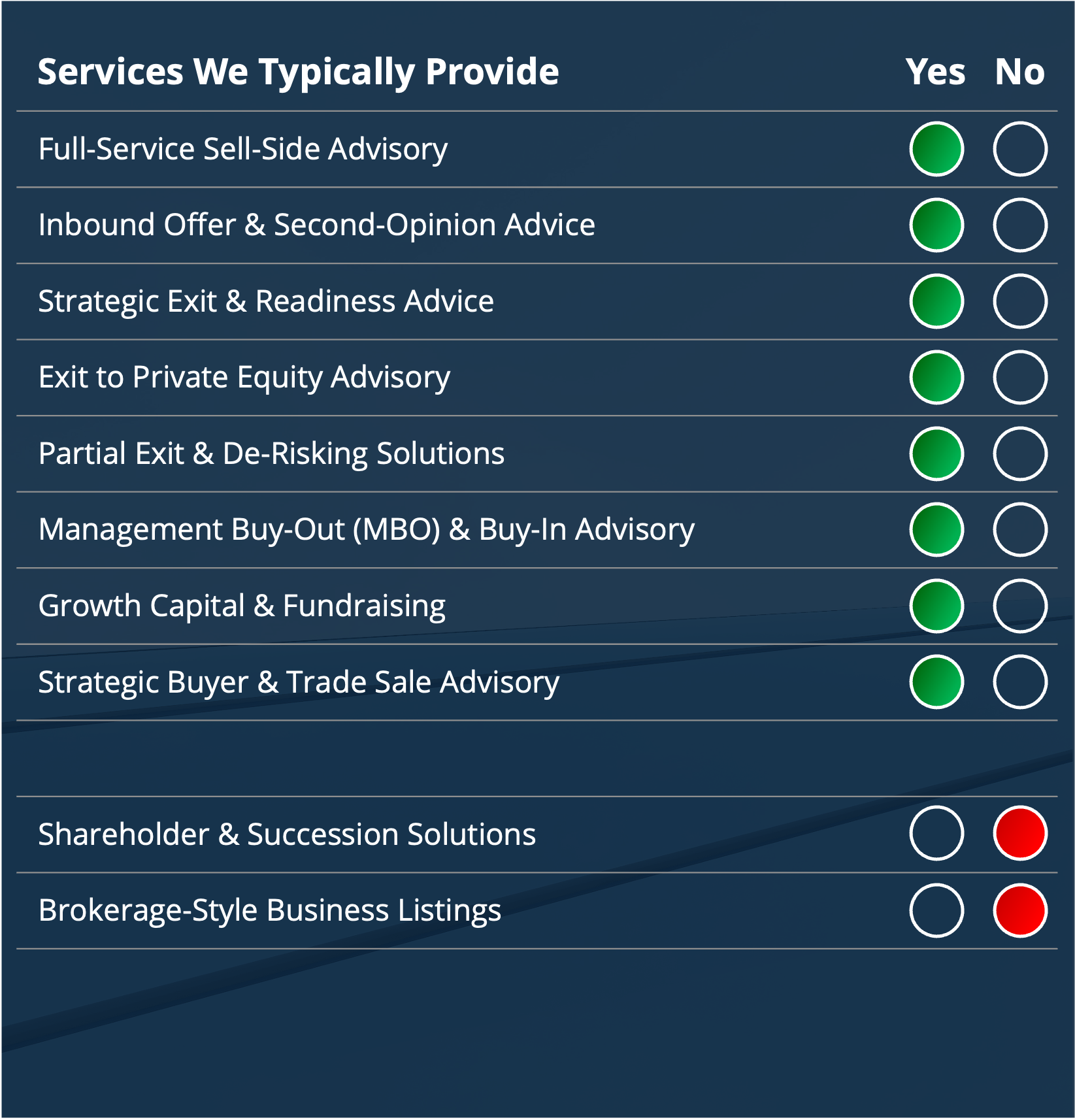

As an independent, privately owned firm that is solely focused on and accountable to our clients, Dyer Baade & Company operates free from the conflicts that can arise at larger firms offering ancillary services such as due diligence, tax, or legal advice.

Our approach is fundamentally strategic. We specialise in developing and implementing the exit strategy that is best aligned with our clients' interests. By anticipating buyer behaviour and addressing issues proactively, we solve even highly complex cases and achieve market-leading results.

Based in St. James’s, London, a major hub for many of Europe’s leading Private Equity firms, Dyer Baade & Company has built strong relationships with a large number of strategic investors, Private Equity firms and Family Offices, in the UK and Europe.

Together with our international team of M&A experts, including seasoned bankers, strategy experts, accountants, and lawyers, we provide unrivalled M&A advice that is distinguished by our dedication, commitment, and ability to deliver market leading results.

When is the right time to get in touch?

What our clients say about us

Find out how we can help you

Whether you call it an initial conversation, a readiness assessment, or an independent perspective - we offer a confidential, no-obligation discussion to help you think clearly about your situation.

We discuss your situation, outline realistic options, and answer the key questions owners typically face - without launching a process or creating expectations.

Frequently asked questions

What happens after I request a call?

A senior member of our team will review your enquiry and will get in touch with you.

When will I hear back?

Usually within one business day.

Will you treat my inquiry confidential?

Yes. Both the fact that you get in touch with us and what you share with us, will stay entirely confidential.

How do I know if you can help or if the timing is right?

We will take the time to understand your enquiry and will give you a confidential and honest feedback.

Who can you help?

To answer this question we have produced a list of the most common situations: