Exit to Private Equity - An Insider Guide for Founders, CEOs, and Professional Investors

This practical 60-page report provides a deep insight into the risks and opportunities of partnering with Private Equity firms across the UK and Europe. It is relevant for founders, CEOs and investors of mid-sized companies, i.e. companies that usually have:

more than €15m revenue; or

more than €5 million adjusted EBITDA; or

more than 50 staff members.

It is based on our practical deal experience from more than 40 transactions and covers all key sectors, including business services, financial services, technology, healthcare, media, etc. and the insights are applicable to companies from all over Europe and the UK, irrespectively if they are located in a major capital or in a regional centre.

After reading the report, you will have a deep understanding of the risks and opportunities of exiting to Private Equity - knowledge that could be worth millions to you.

Free. Confidential. No obligation.

What you will learn from this report

How Private Equity works

Private Equity firms invest based on different strategies. Understanding these strategies will not only allow you to evaluate your options with more confidence, it will also allow you to have a clear strategic advantage in any future negotiation.

How a good deal could look like

A Private Equity will never disclose their hand. However, based on our deep knowledge of the sector, we show you how Private Equity values businesses, what determines the difference between a good deal and an average deal and how far you could push a deal.

How you can achieve a deal with Private Equity at market leading terms

In this report you will learn how you can negotiate better with Private Equity to ensure you do not only get a market leading valuation, but also a better deal structure, roll-over terms and downside protection.

What’s included in this free 60-page report?

Chapter 1 - Who should consider an exit to Private Equity

An exit to Private Equity is not a one-size-fits-all solution.

While it has become an increasingly common path for owners of successful businesses, it is only well suited in specific situations.

Founders, CEOs, and shareholders need to understand the inner workings of the Private Equity model to evaluate a potential fit.

Chapter 2 - Why is selling to Private Equity such an appealing strategy

Founders, CEOs and investors of successful privately owned companies are rarely limited to a single strategic path.

The right choice depends on strategic objectives, financial priorities, and personal expectations.

Private Equity stands apart, because it offers in addition to high valuations, five other key benefits that other strategic options very often fail to deliver.

Chapter 3 - When selling to Private Equity isn’t right

Not all Private Equity investments are successful, and failures are often highly visible and expensive.

You will learn what factors determine the difference between success and failure, how can you avoid key pitfalls and how certain No-Go’s affect different situations.

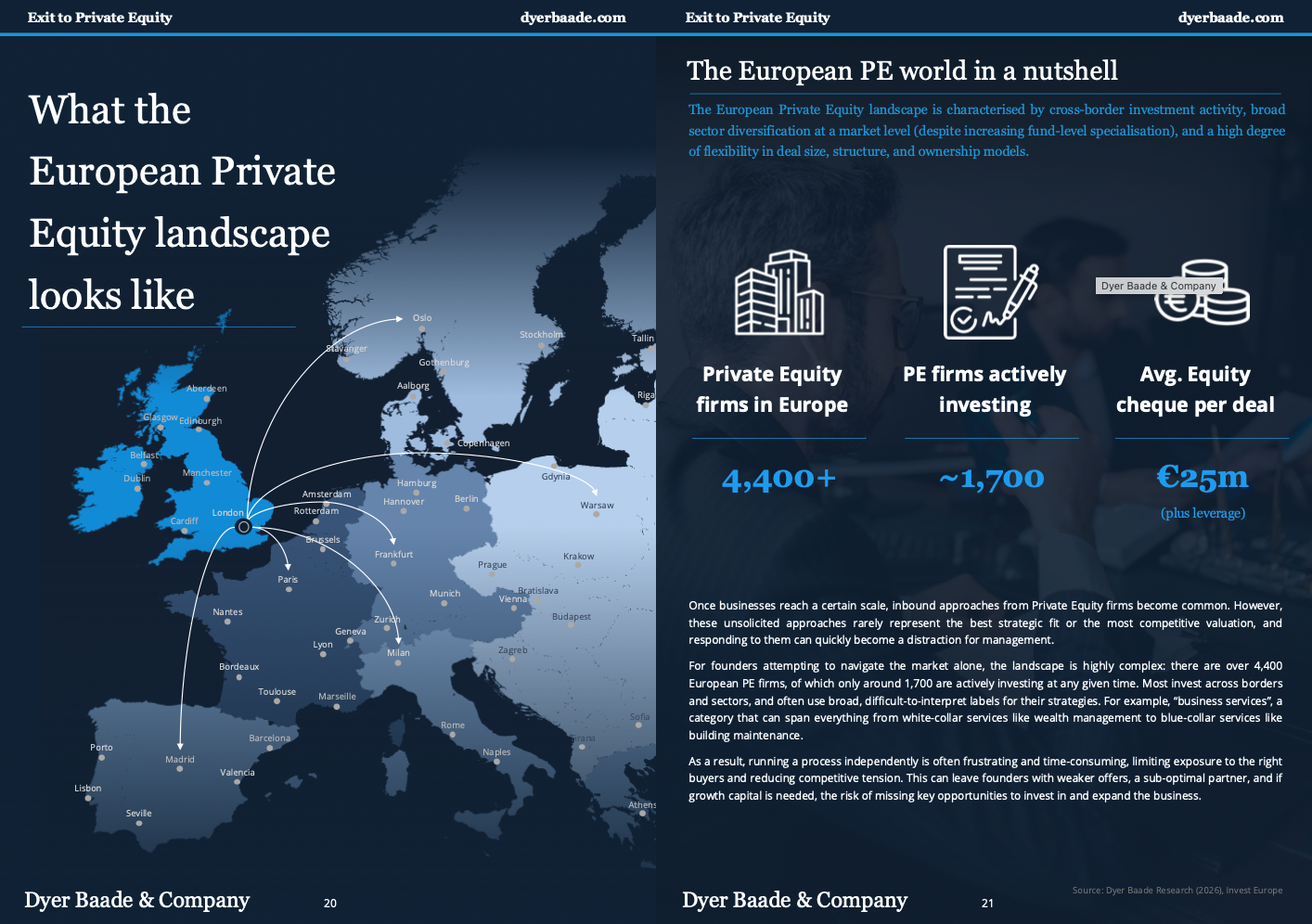

Chapter 4 - What the European Private Equity landscape looks like

The European Private Equity landscape is characterised by cross-border investment activity and a high degree

of flexibility in deal size, structure, and ownership models.

With over 4,400 professional investment firms in Europe, smart founders and CEO can not only create highly competitive processes, but also realise deal structures that are perfectly aligned with their personal preferences.

Chapter 5 - How does Private Equity actually work

Private Equity is not a single investment model, but a collection of distinct strategies applied at

different stages of a company’s lifecycle.

Understanding these strategies gives founders a clear competitive edge.

We show you how the key Private Equity strategies work, and for which situations they are most applicable.

Chapter 6 - What Private Equity really looks for - and PE works with founders and CEOs

We show you how Private Equity measures success, what returns PE firms targeting, and how they plan to achieve these returns.

We also outline key deal killers and how you can improve your negotiation position significantly.

Furthermore, we provide some clear insights into how to engage with Private Equity at the different stages of their investment process to ensure you can realise the best possible deal terms.

Chapter 7 - What valuations are possible

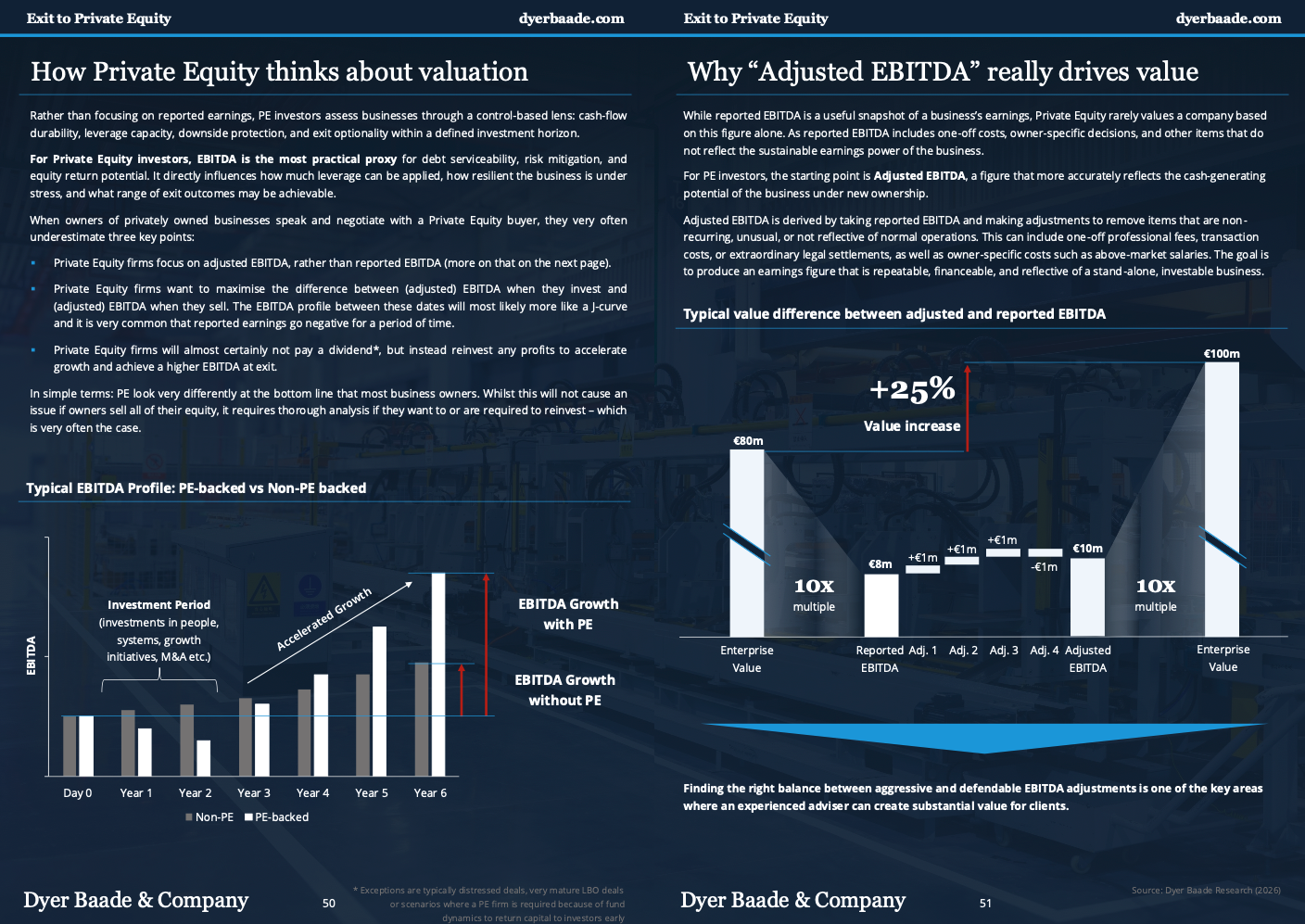

How Private Equity things about Valuation

Why adjusted EBITDA really drives value

Multiples paid by sector

We show you why two firms from the same sectors with the same financials can trade at very different valuations, and how you can ensure that your valuation is closer to the top end of the market.

About the Author - Dr. Daniel Baade

Daniel is CEO and majority shareholder of Dyer Baade & Company - a leading M&A advisory boutique specialised on advising founders, CEOs and investors of privately owned businesses on their exit to Private Equity.

The firm is authorised and regulated by the FCA, and engineers premium outcome for its clients through its i) independent perspective, ii) strategic foresight, and iii) international reach.

Based in St. James, London, the firm has forget deep relationships with key Private Equity investors in the UK and across Europe, giving its clients a clear competitive advantage, that translates into industry leading KPIs:

+40

Transactions

~85%

of deals involve

Private Equity

+90%

Transaction success rate

+34%

average valuation premium achieved

Frequently asked questions

Who should read the report?

Founders, CEOs and investors of mid-sized companies, i.e. companies that usually have either more than €15m revenue, or more than €5 million adjusted EBITDA, or more than 50 staff members.

Why is this report special?

Across more than 60 pages, you’ll gain never-before-seen insight into the ins and outs of dealing with private equity, based on our practical experience with leading PE firms in the UK and Europe.

Is the report useful, even if I’m not ready to sell?

Yes.

Is the report free?

Yes, the report is free without any obligation.

What do I need to do to get the report?

Just fill out the form (takes less than 1 minute) and you can download the report as a pdf straight away.